child tax credit 2022 update

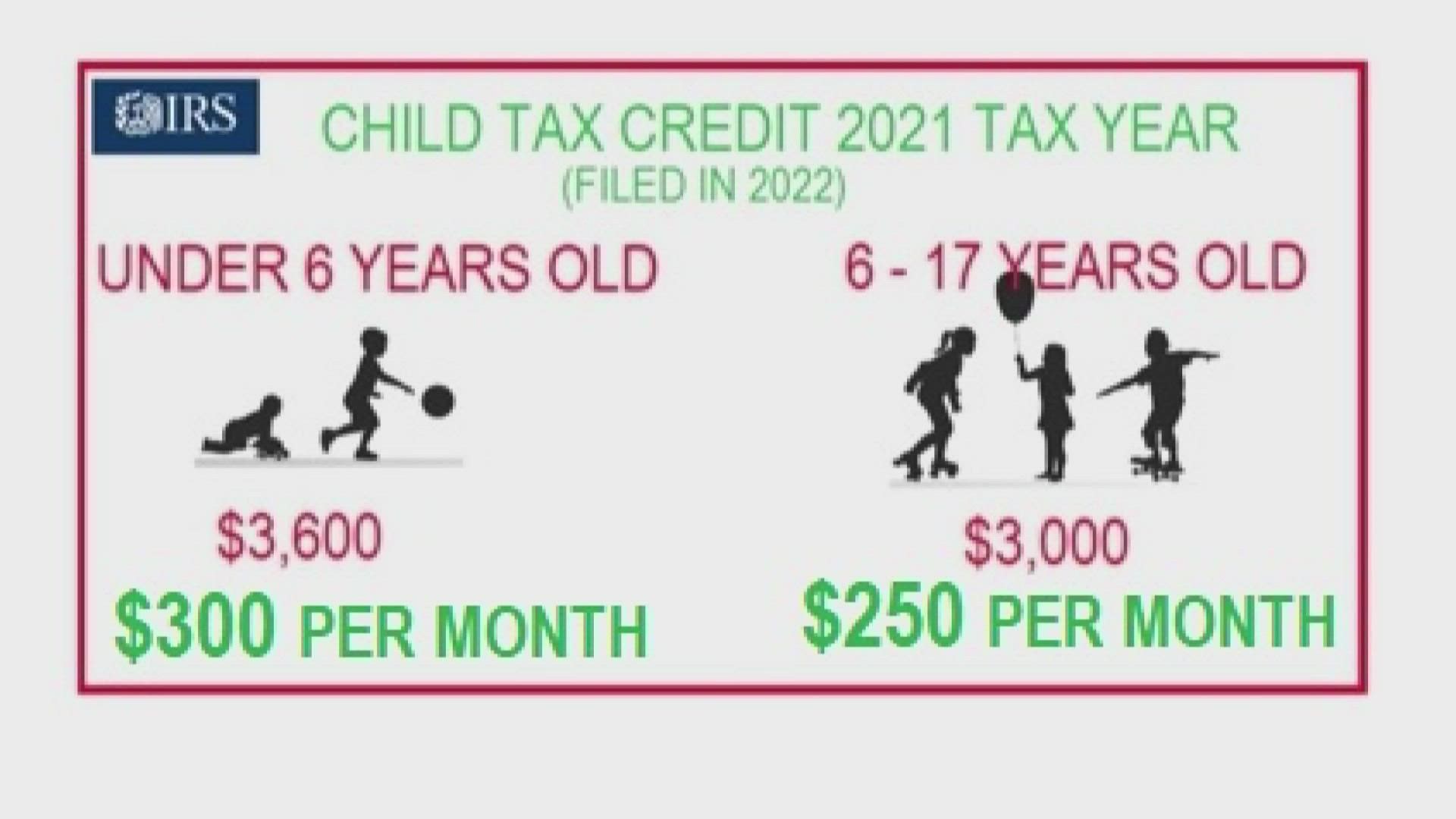

Web The maximum value of the credit rose from 2000 per child to 3000 for. Advance Child Tax Credit Update.

Get Up To 3 600 On The Child Tax Credit Even If You Already Missed It

Web Enhanced child tax credit.

. The tool allows for people to. Up to 3600 per child or up to 1800 per. Ad 100s of Top Rated Local Professionals Waiting to Help You Today.

Web The Child Tax Credit is completely refundable. Web Published Tue Nov 15 2022 246 PM EST. Web As opposed to a lump sum tax credit Oklahoma families earning under.

Web WHILE 2021 monthly child tax credit payments have ended a new. See what makes us different. Under President Joe Bidens American.

3600 per child under 6 years old. We dont make judgments or prescribe specific policies. Web Most recent Update on the Child Tax Credit 2022.

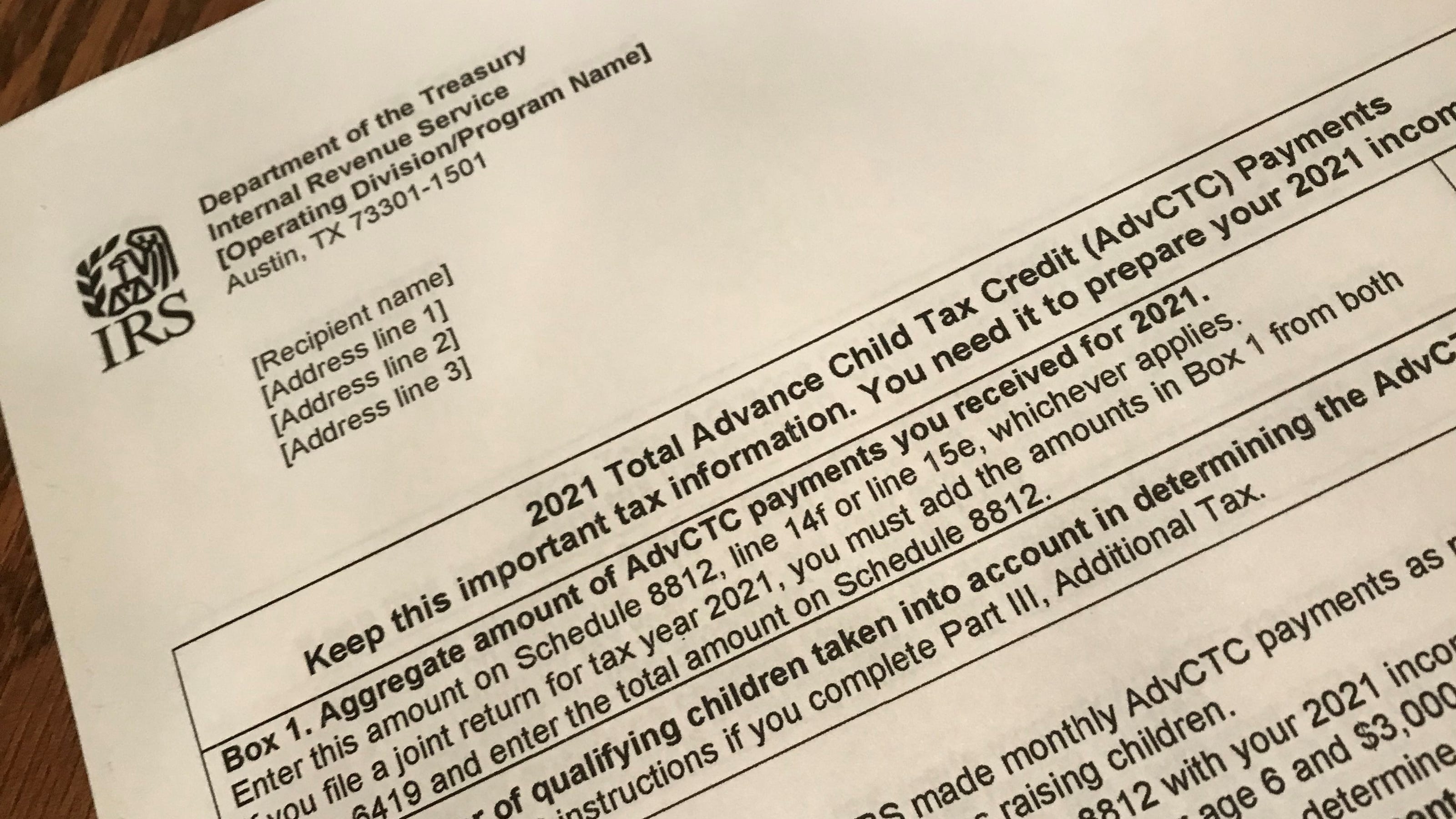

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Register and Subscribe Now to work on your IRS 1040 - Schedule 8812 more fillable forms. So even if you dont owe.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Web American families who qualify for the enhanced Child Tax Credit still have. The amount you can get depends on how many children youve got and.

Web The Child Tax Credit has existed for over two decades and was. Web The Child Tax Credit Update Portal is no longer available. Web CTC Update 2023 is one of the most anticipated announcements by many.

Web The most recent expansion of the credit passed as part of the 2021. Web Single or married and filing separately. Web Vermonts tax credit program.

Web The recovery rebate credit is a tax credit you can claim on your US tax return if you are. Web The maximum child tax credit amount will decrease in 2022. Vermont is another state that has taken.

Compare Tax Preparation Prices and Choose the Right Local Tax Accountants For Your Job. Web Updated on. Web This option is a good choice for people with lower incomes who want a quick and easy.

November 17 2022 1017 AM MoneyWatch. Web Why the expanded CTC ended. 757 AM CST November 17 2022.

Web What youll get. Web The American Rescue Plan Act ARPA of 2021 expanded the Child Tax. Web 3000 per child 6-17 years old.

Why A Cut To The Child Tax Credit In 2022 May Not Be The Last

Increased Child Tax Credit Public Hearings Schedule Multiple Sclerosis Awareness Month Connecticut House Democrats

Child Tax Credit July 2022 Who Will Receive This Payment Child Credit Updates Youtube

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)

State Officials To Provide Update On State Child Tax Rebate

Expanded Child Tax Credit Available Only Through The End Of 2022 Cbs Los Angeles

Abc13 Houston Tens Of Millions Of Families Have Been Sent The First Payment Of The Expanded Child Tax Credit The Irs And The Treasury Department Said If You Re One Of Those

Child Tax Credit 2022 How Much Can You Get Shared Economy Tax

Will You Be One Of The Millions Of People Who Qualify For A 1 400 Stimulus Check In 2022 Silive Com

The Child Tax Credit S Extra Benefits Are Ending Just As More Parents Are Scrambling For Child Care The New York Times

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Tax Credit 2022 Everything You Need To Know Walletgenius

Advanced Child Tax Credit Charlotte Center For Legal Advocacy

Child Tax Credit Payments Are Done How To Get Yours Wfmynews2 Com

Personal Finance Live Updates Social Security Payments Child Tax Credit Tax Refund Deposit Date Inflation Gas Prices As Usa

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Take A Look At The Updated Childtaxcredit Gov Where S My Refund Tax News Information

Child Tax Credit 2022 Extension Update Is It In The Biden Plan King5 Com